Address

26/B, Luxury D Zakia Tower, Dhaka 1217

Phone: (+880) 01765777023

What Is Bangladesh’s Renewable Energy Policy 2025 and What Are Its Solar Targets?

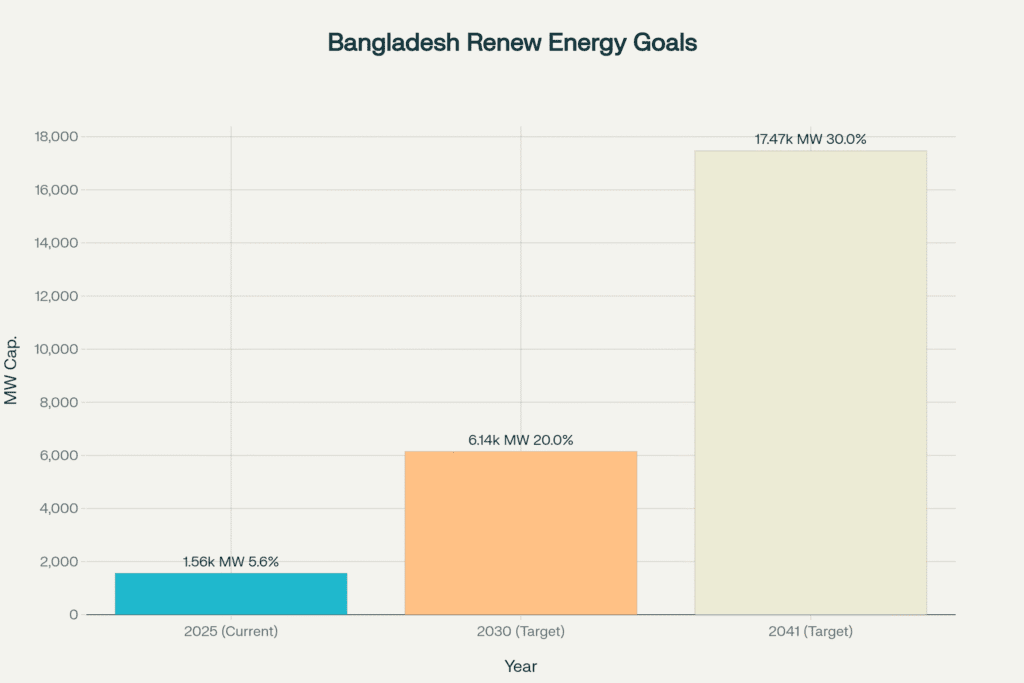

Bangladesh’s Renewable Energy Policy 2025 sets ambitious targets to generate 20% of electricity from renewable sources by 2030 and 30% by 2041, with solar energy leading the transition. The policy includes a comprehensive framework for rooftop solar programs, floating solar projects, waste-to-energy initiatives, and substantial investment incentives including 10-year tax exemptions for renewable energy producers.

What Are the Key Targets in Bangladesh’s Renewable Energy Policy 2025?

The Renewable Energy Policy 2025 establishes transformative targets that represent a significant departure from Bangladesh’s historically fossil fuel-dependent energy sector. The policy aims to generate 20% of total electricity from renewable sources by 2030, equivalent to 6,145 MW, and 30% by 2041, reaching 17,470 MW.

Current Baseline and Growth Requirements

Bangladesh currently generates only 5.6% of its total electricity demand from renewable sources, with approximately 1,563 MW of grid and non-grid renewable energy capacity as of 2025. This represents a massive gap requiring annual renewable energy capacity additions of approximately 750 MW between 2025 and 2030 to meet the policy targets.

Technology-Specific Allocations

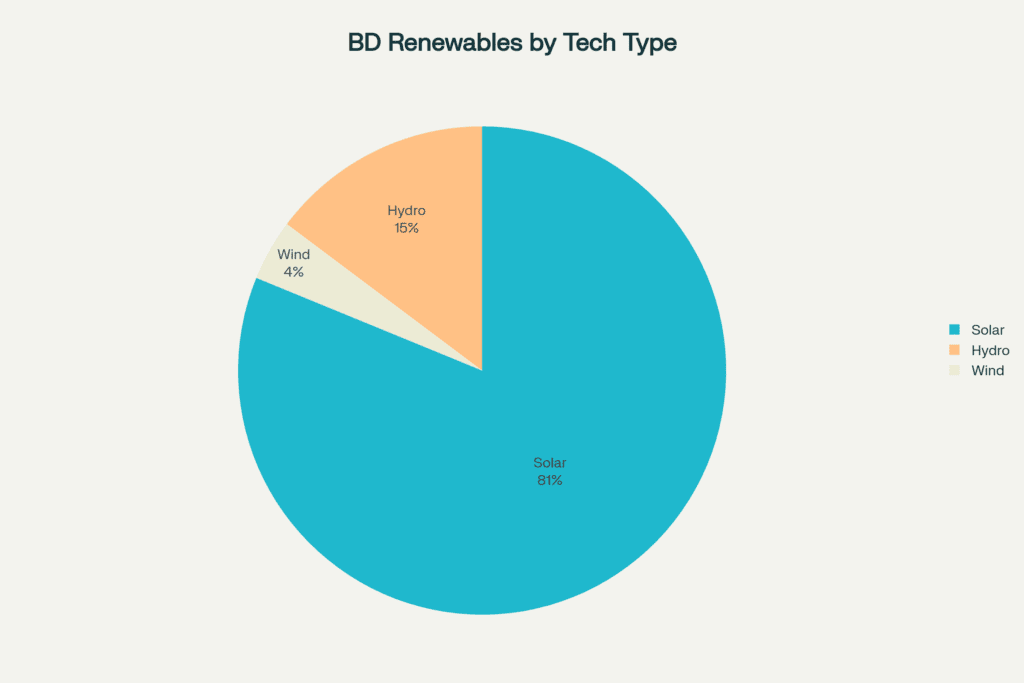

The policy encompasses multiple renewable energy technologies including solar photovoltaic, wind energy, biomass, biogas, hydropower, waste-to-energy, biofuels, geothermal, tidal waves, and green hydrogen. Solar energy dominates the renewable energy mix, accounting for 81% of current renewable capacity with 1,265 MW installed.

Long-term Vision Framework

The Integrated Energy and Power Master Plan (IEPMP) 2023 forecasts maximum power demand reaching 27.4-29.3 GW by 2030, 50.4-58.6 GW by 2040, and 70.5-96.8 GW by 2050, with corresponding renewable power generation targets of 10% in 2030, 22% in 2040, and 35% in 2050.

How Does Solar Energy Dominate Bangladesh’s Renewable Strategy?

Solar energy forms the cornerstone of Bangladesh’s renewable energy transition, with the government launching comprehensive programs to maximize solar deployment across multiple sectors.

National Rooftop Solar Program

Chief Adviser Muhammad Yunus has ordered the installation of solar panels on all government institutions including ministry buildings, schools, colleges, hospitals, and madrasas. This initiative mandates private sector companies to install and operate the panels while the government provides rooftop access, ensuring business interests align with system maintenance and operational efficiency.

Utility-Scale Solar Development

The government has initiated tender processes for 55 solar power plants with a total capacity of 5,238 megawatts. These large-scale projects represent the backbone of Bangladesh’s solar expansion strategy, designed to provide significant grid-connected renewable capacity.

Solar Market Growth Projections

The Bangladesh Solar Energy Market is projected to grow from 0.76 gigawatt in 2025 to 3.90 gigawatt by 2030, representing a compound annual growth rate (CAGR) of 38.6% during the forecast period. This growth trajectory aligns with government targets and demonstrates strong market confidence in solar technology adoption.

Net Metering and Distributed Generation

The Net Metering Guidelines 2018 enable all customer categories—residential, industrial, and commercial—to install renewable energy systems and sell excess power to the grid. Under this framework, consumers can install rooftop solar systems covering up to 70% of their sanctioned load capacity and receive compensation for surplus energy supplied to the grid.

What Financial Incentives Does the Policy Provide?

The Renewable Energy Policy 2025 introduces substantial financial incentives designed to attract both domestic and international investment in the renewable energy sector.

Tax Exemption Framework

The policy offers 10-year corporate tax exemptions for all government and private renewable energy producers, followed by an additional five years of partial tax exemption. This 15-year tax benefit structure provides significant financial advantages for renewable energy investments.

Investment and Grant Support

The European Investment Bank has committed €350 million in framework loans with €45 million EU grant support to enable installation of approximately 750 MWp of renewable energy capacity. Additionally, the government proposed a special allocation of Tk 1 billion (approximately $100 million) to encourage renewable energy development and use in the FY2024-25 budget.

Import Duty Waivers and Financing Support

The policy framework includes recommendations for import duty waivers on solar accessories and establishment of credit risk guarantee schemes to accelerate financing for small-scale renewable energy projects. These measures address key barriers to renewable energy adoption and deployment.

Public-Private Partnership Models

The rooftop solar program emphasizes private sector involvement where companies install, maintain, and operate systems while receiving revenue from electricity generation. This model ensures sustainable business operations while reducing government financial burden and technical responsibility.

Which Government Agencies Lead Implementation?

The renewable energy policy implementation involves multiple government agencies with clearly defined roles and responsibilities.

Sustainable and Renewable Energy Development Authority (SREDA)

SREDA serves as the primary implementing agency with substantial responsibility for renewable energy technology development, program implementation, roadmap development, and incentive creation. Established in 2014, SREDA coordinates renewable energy efforts, standardizes products, pilots new technologies, and creates conducive investment environments.

Bangladesh Energy Regulatory Commission (BERC)

BERC holds responsibility for providing licenses for renewable energy plants with capacity of 5 MW or more. The commission determines tariffs, issues licenses, and ensures transparency in energy sector management while protecting consumer interests.

Implementation Authority Structure

SREDA will introduce Renewable Energy Certificates (REC) and Renewable Purchase Obligations (RPO) as regulatory mechanisms. The authority also manages the National Solar Help Desk (NSHD) to provide comprehensive support for rooftop solar project implementation under net metering guidelines.

Regulatory Coordination Framework

The Power Division of the Ministry of Power, Energy and Mineral Resources oversees policy formulation while SREDA handles technical implementation and BERC manages regulatory aspects. This multi-tiered approach ensures comprehensive coverage of policy, technical, and regulatory requirements.

What Role Do Floating Solar and Innovative Projects Play?

Bangladesh is pioneering innovative renewable energy technologies that address land scarcity challenges while maximizing energy generation potential.

Floating Solar Development

Bangladesh has immense potential to generate approximately 11,000 megawatts peak (11GWp) of electricity from floating solar photovoltaics according to International Finance Corporation screening of 323 water bodies larger than 25 acres. The first commercial floating solar project with 784 kWp capacity has been successfully connected to the national grid, demonstrating the viability of this technology.

Waste-to-Energy Initiatives

The government is developing Bangladesh’s first waste-to-energy plant in Aminbazar with 42.5 MW capacity, processing 3,000 tons of municipal waste daily. China Machinery Engineering Corporation is implementing this $300 million project with a 25-year power purchase agreement, representing a significant advancement in renewable energy diversification.

Benefits of Innovative Technologies

Floating solar panels reduce water evaporation by 6-10% while increasing electricity generation efficiency due to cooling effects from underlying water. These projects address land scarcity issues while creating synergies between different sectors such as aquaculture and energy generation.

Scaling Potential and Future Projects

The Asian Development Bank has committed $2.34 million for technical assistance to assess floating solar potential and develop renewable energy investment plans. Additional floating solar projects are planned for Kaptai Lake (50 MW) and Padma River locations, indicating substantial expansion potential.

How Will Peer-to-Peer Energy Trading Transform the Sector?

The Renewable Energy Policy 2025 introduces peer-to-peer (P2P) energy trading as a revolutionary approach to decentralized electricity distribution and community-level energy management.

P2P Trading Framework

The policy encourages peer-to-peer trade in renewable energy through a decentralized system that enables electricity consumers with solar panels to directly trade excess electricity with other consumers using distribution and transmission networks. This system operates without central utility intermediation, providing greater autonomy and potential cost savings for participants.

Existing P2P Infrastructure

Bangladesh already hosts successful P2P energy trading platforms, with ME SOLshare operating 48,000 PV capacity (Wp) through their SOLbazaar IoT-driven trading platform. The platform consists of SOLbox (bidirectional DC meter), SOLapp, and SOLweb components that facilitate energy trading and mobile money payments.

Economic Impact and Benefits

Research indicates that blockchain-enabled P2P energy trading systems have potential to reduce consumer electrical expenditure by 17%. The system allows prosumers to earn revenue from excess energy while enabling consumers to purchase electricity at cheaper rates compared to main grid prices.

Mini-Grid and Micro-Grid Integration

Electricity distribution companies will implement solar mini, micro, nano, and pico grids or hybrid systems in areas where national grid electrification is not feasible. Private sector entities may install and operate these decentralized systems on competitive market basis with tariffs determined by BERC.

What Investment Requirements Are Needed to Meet Targets?

Meeting Bangladesh’s renewable energy targets requires substantial financial commitments that exceed current public sector funding capabilities.

Annual Investment Needs

According to the Institute of Energy Economics and Financial Analysis (IEEFA), Bangladesh requires between $933 million and $980 million annually until 2030 to achieve the 20% renewable energy target. Post-2030, the country needs between $1.37 billion and $1.46 billion annually until 2040 to reach the 30% target.

Public Finance Limitations

Public finance alone is unlikely to meet these funding requirements, necessitating large-scale private investment. The scale of required investment represents a significant portion of Bangladesh’s annual development budget, highlighting the need for innovative financing mechanisms and international support.

Investment Barriers and Challenges

Several factors limit capital flows into Bangladesh’s renewable energy sector including policy uncertainty, off-taker risk, currency volatility, land acquisition challenges, and downgraded sovereign rating. Recent policy shifts, including suspension of 31 utility-scale renewable energy projects, have created contractual uncertainties affecting investor confidence.

Financing Solutions and Recommendations

IEEFA recommends establishing currency hedging funds to mitigate currency risks and engaging with multilateral development banks, international climate finance institutions, and bilateral development financial institutions. Additional measures include reinstating project implementation clauses and creating funding mechanisms for revenue assurance to renewable energy producers.

How Does Bangladesh Compare to Regional Neighbors?

Bangladesh significantly lags behind regional neighbors in renewable energy adoption, highlighting the urgency and ambition of the new policy framework.

Regional Renewable Energy Performance

While Bangladesh produces only 5.6% of total electricity demand from renewable sources, neighboring countries demonstrate much higher adoption rates. India generates 24% of total electricity demand from renewable sources, Pakistan produces 17.16%, and Sri Lanka achieves nearly 40%.

Comparative Analysis and Gaps

This performance gap demonstrates Bangladesh’s substantial potential for renewable energy growth while highlighting the challenges of late adoption. The country’s current renewable energy percentage places it well below the global average of 13% and significantly behind regional leaders.

Learning from Regional Success

Bangladesh can leverage regional experiences and best practices, particularly from India’s large-scale solar programs and Sri Lanka’s diversified renewable energy portfolio. The policy framework acknowledges these gaps and sets ambitious targets to achieve regional competitiveness within the next decade.

Strategic Positioning for Growth

Despite current lag, Bangladesh’s high population density and growing economy create substantial demand for energy solutions. The combination of abundant solar irradiance (5 kWh/m²/day), extensive water bodies for floating solar, and strong policy commitment positions the country for rapid renewable energy expansion.

Start Your Renewable Energy Journey Today

Ready to contribute to Bangladesh’s renewable energy transformation? Explore opportunities in solar installation, energy trading platforms, or sustainable technology investments. Contact renewable energy authorities or consult with energy sector professionals to understand how you can participate in this growing market.

TL;DR: Bangladesh’s Renewable Energy Policy 2025 Overview

- Ambitious Targets: 20% renewable electricity by 2030 (6,145 MW), 30% by 2041 (17,470 MW)

- Solar Leadership: National rooftop program for all government buildings, 5,238 MW utility-scale projects

- Financial Incentives: 10-year tax exemptions, €350M EU investment, Tk 1B government allocation

- Innovation Focus: Floating solar (11GWp potential), waste-to-energy (42.5 MW), P2P energy trading

- Investment Needs: $980M annually to 2030, $1.46B annually 2030-2040

- Current Status: 5.6% renewable share vs. regional leaders (India 24%, Sri Lanka 40%)

- Key Agencies: SREDA (implementation), BERC (regulation), private sector partnerships

The policy represents Bangladesh’s most comprehensive renewable energy framework, designed to transform the country from fossil fuel dependence to sustainable energy leadership in South Asia.

About the Expert

Muhammad Nayeem Ferdous is the Chairman and Founder of Amar Ghor BD, providing comprehensive 360-degree property services across Bangladesh. With an MBA from Macquarie University and over 5 years of industry experience, he specializes in renewable energy policy analysis, sustainable development initiatives, and helping property investors understand the impact of green energy transitions on real estate values and development opportunities.

People Also Ask

Q: What is the difference between the 2008 and 2025 renewable energy policies in Bangladesh?

A: The 2008 policy set modest targets of 5% renewable energy by 2015 and 10% by 2020, while the 2025 policy dramatically increases ambitions to 20% by 2030 and 30% by 2041, with comprehensive implementation frameworks and substantial financial incentives.

Q: How does net metering work in Bangladesh?

A: Net metering allows consumers to install rooftop solar systems up to 70% of their sanctioned load, sell excess electricity to the grid, and receive bill credits or payments based on the difference between energy consumed and generated each month.

Q: What are the main challenges to achieving Bangladesh’s renewable energy targets?

A: Key challenges include securing $980 million annual investment, addressing land acquisition difficulties, managing currency volatility, ensuring policy stability, and building technical capacity across the renewable energy value chain.

Q: Can private companies participate in Bangladesh’s renewable energy sector?

A: Yes, the policy strongly encourages private sector participation through rooftop solar programs, utility-scale project development, P2P energy trading platforms, and public-private partnerships with 10-year tax exemptions as incentives.

Q: What makes floating solar attractive for Bangladesh?

A: Bangladesh’s riverine geography provides 11GWp floating solar potential, addressing land scarcity while reducing water evaporation, increasing energy efficiency by 6-10%, and creating synergies with aquaculture and other water-based activities.