Address

26/B, Luxury D Zakia Tower, Dhaka 1217

Phone: (+880) 01765777023

Dhaka Real Estate Market: Comprehensive Guide for 2025

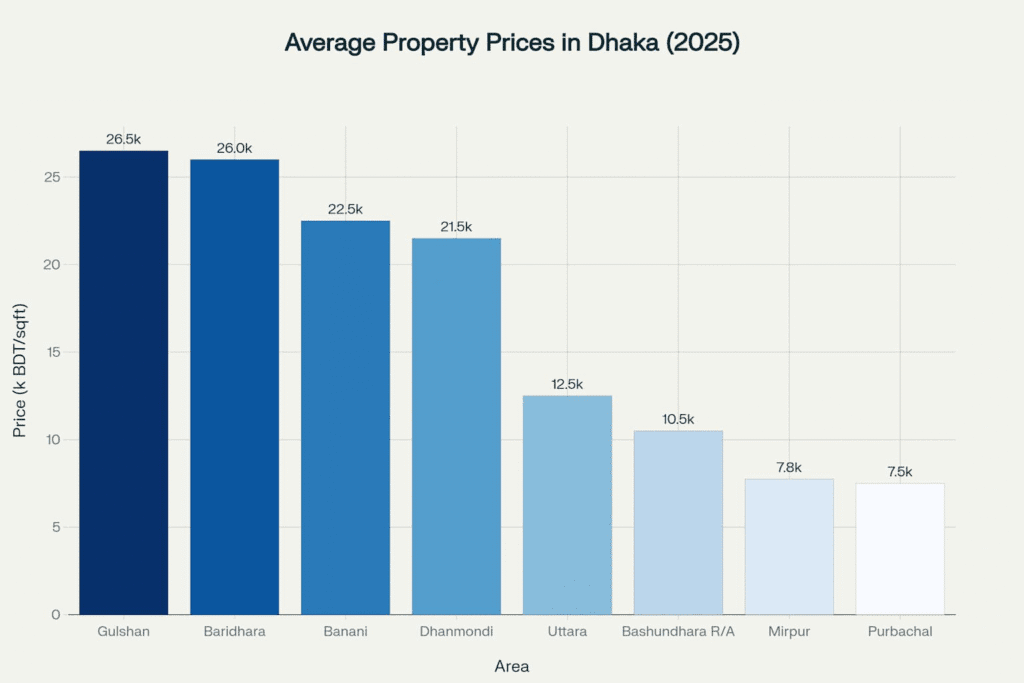

As of April‑May 2025, Dhaka’s residential property prices range roughly from BDT 6,000–16,000/sq ft, with luxury areas like Gulshan and Baridhara commanding BDT 22,000–35,000/sq ft. Average 2‑bed apartments cost around USD 36,000.

Dhaka’s real estate market stands as one of South Asia’s most dynamic and promising investment destinations in 2025. With a metropolitan population exceeding 22 million and continuous urban migration, the capital city presents unprecedented opportunities for both residential and commercial property investments. The market has fully recovered from pandemic-induced challenges and is now experiencing robust growth driven by infrastructure development, digitization, and favorable government policies.

Market Overview and Key Growth Drivers

Population Dynamics and Urbanization

Bangladesh’s middle-class population is projected to reach over 34 million by 2025, with the majority concentrated in or around Dhaka. This demographic shift, combined with continuous rural-to-urban migration, creates sustained demand for housing across all income segments. According to UN projections, 60% of Bangladesh’s population will live in urban areas by 2040, with Dhaka serving as the primary destination for employment and educational opportunities.

Infrastructure Revolution

The transformation of Dhaka’s infrastructure landscape is fundamentally reshaping property values and investment opportunities. The Dhaka Metro Rail (MRT), elevated expressways, and the development of satellite towns like Purbachal are improving connectivity and unlocking new real estate corridors. These mega projects are expected to be completed by 2025, further strengthening the market’s foundation.

Economic Fundamentals

Foreign remittances play a crucial role in real estate investments, particularly among Non-Resident Bangladeshis (NRBs). In FY2023 alone, Bangladesh received USD 24.73 billion in remittances, with a significant portion invested in Dhaka’s prime property zones. The government’s pro-business policies, including tax rebates, housing loans, and incentives for green building construction, are encouraging sustained investment.

Property Market Segmentation

Affordable Housing Segment

The affordable housing sector addresses the growing urban middle class with properties ranging from BDT 45-80 lakh. Key locations include Mirpur, Jatrabari, Mohammadpur, and Badda, offering basic amenities with shared parking and proximity to essential services. This segment typically features 800-1,200 square feet units with developer-offered installment plans.

Mid-Income Housing Market

Representing the largest segment of Dhaka’s apartment market, mid-income housing ranges from BDT 85 lakh to 1.3 crore. Preferred areas include Uttara, Bashundhara, and parts of Aftabnagar, featuring elevators, standby generators, security guards, and mid-range fittings. This segment caters to nuclear families and first-time homebuyers seeking modern amenities at reasonable prices.

Luxury Properties

Comprising under 10% of all units, luxury properties command BDT 2-6 crore and above. Prime zones include Gulshan, Baridhara, Banani, and Bashundhara Block D, featuring smart home automation, dedicated security, concierge services, and private amenities like pools and rooftop gardens. Post-pandemic trends show increased demand for health-conscious designs, energy efficiency, and green certifications.

Prime Investment Locations

Premium Investment Zones

Gulshan and Banani remain Dhaka’s most prestigious neighborhoods, attracting NRBs, corporate executives, and foreign missions. Property prices in Gulshan range from BDT 18,000 to BDT 35,000 per square foot, while Banani commands BDT 15,000 to BDT 30,000 per square foot. These areas offer diplomatic zone advantages, international schools, restaurants, and commercial hubs.

Baridhara stands out with prices ranging from BDT 22,000 to BDT 30,000 per square foot. The Diplomatic Zone within Baridhara is particularly expensive due to its secure environment, well-maintained surroundings, and proximity to embassies and international organizations.

Emerging Growth Areas

Uttara presents excellent investment potential with Metro Rail access and proximity to the airport. Property prices range from BDT 9,000 to BDT 16,000 per square foot, targeting mid-income buyers, expats, and small business owners. The area benefits from modern infrastructure and planned development.

Purbachal New Town represents the future of Dhaka’s urban development as a planned satellite city spanning 6,227 acres. With smart city infrastructure and future expressway connections, property prices currently range from BDT 6,000 to BDT 9,000 per square foot1. Early investors in Purbachal’s Sector 16 have experienced 45% value appreciation since 2022.

Bashundhara Residential Area offers strategic advantages with proximity to top universities (NSU, IUB), hospitals, and shopping centers like Jamuna Future Park. Property prices range from BDT 8,000 to BDT 13,000 per square foot, making it attractive for upper-middle-class families and long-term investors.

Affordable Investment Options

Mirpur provides the most affordable entry point with prices ranging from BDT 5,500 to BDT 10,000 per square foot. The area benefits from good road connectivity and an expanding Metro network, making it ideal for first-time homebuyers and government service holders.

Investment Returns and Market Performance

Rental Yield Analysis

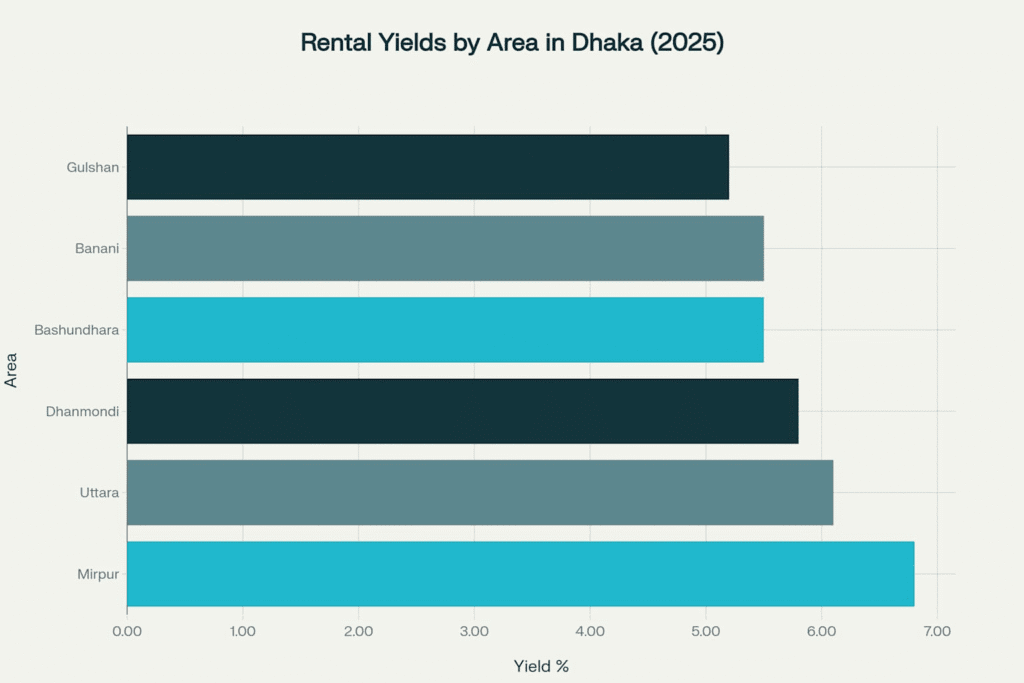

Dhaka’s rental market offers attractive yields across different segments. The average gross rental yield in Bangladesh stands at 5.77% as of Q2 2025. Premium areas like Gulshan provide 5.2% rental yields with 7.5% property value appreciation. Uttara offers higher rental yields at 6.1% with 6.3% appreciation, while Mirpur leads with 6.8% rental yields despite moderate 4.5% appreciation.

ROI Projections

Investment returns vary by location and property type. Purbachal plots show exceptional performance with 18-22% ROI over five years and 12% annual appreciation. Gulshan high-rises offer 9-12% ROI with 5.8% rental yields and 7% annual appreciation. Expressway villas present the highest potential with 25-30% ROI and 15% annual appreciation.

Secondary Market Opportunities

The resale market has emerged as a significant growth area in 2025. Secondary properties offer several advantages including faster transaction cycles, location benefits in established neighborhoods, and competitive pricing typically 10-20% lower than new constructions. Popular secondary markets include Dhanmondi (BDT 12,000-18,000 per square foot), Uttara (BDT 7,000-12,000 per square foot), and Mohammadpur (BDT 6,000-12,000 per square foot).

Digital platforms like Amar Ghor BD have enhanced transparency and streamlined legal verifications, making secondary transactions more accessible to millennials and foreign investors. The secondary market attracts first-time homeowners seeking affordability, investors targeting rental yields from ready flats, and NRBs preferring hassle-free, move-in ready units.

Market Challenges and Risk Factors

Regulatory and Legal Complexities

The Dhaka real estate market faces several structural challenges. Regulatory hurdles include delays in mutation and registration processes, complications in verifying land titles, and bureaucratic obstacles in obtaining construction permits. These issues require careful due diligence and professional assistance.

Market Volatility Factors

Price volatility stems from construction material cost fluctuations, including cement, rods, and tiles. Exchange rate fluctuations impact costs for imported fixtures, while financing bottlenecks and rising interest rates affect buyer accessibility. Urban planning issues such as overcrowding, traffic congestion, and inadequate infrastructure in central areas pose additional challenges.

Investment Risks

Investor concerns include incomplete or delayed projects, lack of transparency in builder reputations, and fraud risks in secondary transactions. Developers face labor shortages, land acquisition challenges, and environmental impacts from rapid construction. These factors require careful market research and professional guidance.

Future Market Outlook

Growth Projections (2025-2030)

The Dhaka real estate market is projected to maintain strong growth momentum through 2030. Expected average ROI growth ranges from 5.5% in 2025 to 7.0% by 2029. Urban migration, Metro Rail expansion, and smart city initiatives will continue driving rental demand and property values.

Emerging Trends

Key trends shaping the market include increased demand for green buildings and smart home features. Mixed-use developments combining residential, commercial, and retail spaces are gaining popularity. Government initiatives promoting affordable housing through RAJUK partnerships with private developers are expanding market accessibility.

Investment Recommendations

Strategic investment approaches include buy-to-let strategies for high rental income, fix-and-flip opportunities in prime locations like Dhanmondi, and long-term appreciation plays in emerging zones like Purbachal. Areas near Metro Rail stations and new expressway connections offer exceptional growth potential.

Ready to explore your options?

Dhaka’s real estate market in 2025 represents a compelling investment opportunity driven by strong fundamentals, infrastructure development, and demographic trends. While challenges exist, the market’s transparency improvements, digital innovation, and government support create a favorable environment for both residential and commercial investments. Success requires careful location selection, professional guidance, and understanding of market dynamics across different segments.

The convergence of urbanization, infrastructure upgrades, and economic growth positions Dhaka’s real estate market for continued expansion through the decade. Investors who enter the market with proper research and strategic planning can benefit from this dynamic growth story.

Contact Amar Ghor BD today to leverage our expertise in property valuation, and tailored investment strategies. Let us guide you toward your dream home or profitable venture!