Address

26/B, Luxury D Zakia Tower, Dhaka 1217

Phone: (+880) 01765777023

What Are the Top Mistakes to Avoid When Buying an Apartment in Dhaka?

Buying an apartment is one of the most significant financial and life decisions you’ll ever make. In Bangladesh’s dynamic real estate market, particularly in Dhaka, this investment can easily represent 5-10 years of family savings or more. Yet many first-time buyers make preventable mistakes that cost them hundreds of thousands of taka, years of legal battles, or worse – complete financial loss through fraud or developer abandonment.

The stakes are high: research shows that within the first year of ownership, approximately 40% of apartment buyers in Dhaka encounter problems ranging from structural defects to payment disputes, many of which could have been prevented through proper due diligence and informed decision-making.

Before You Even Look – Building a Strong Foundation

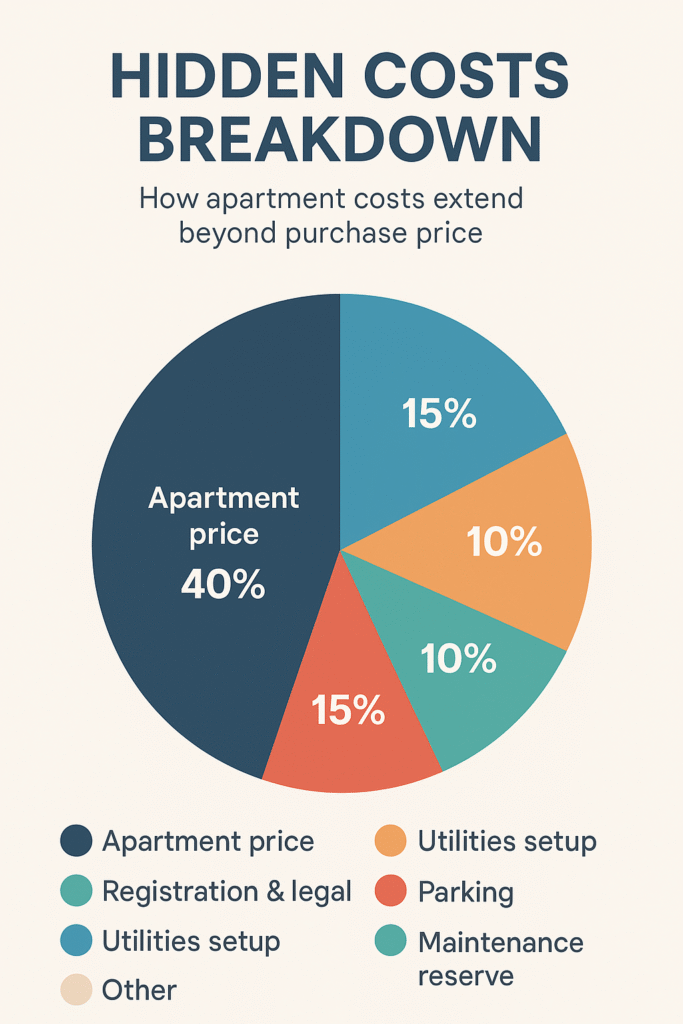

Mistake #1: Setting an Unrealistic Budget & Ignoring Hidden Costs

The Problem: Most buyers focus only on the sticker price per square foot, but apartments in Dhaka involve significant additional expenses that often surprise buyers after commitment.

What Gets Overlooked:

- Registration & Legal Fees: 3-6 lakhs (for a ৳1 crore property)

- Utility Connection Charges:

- Electricity (DESA/DPDC): ৳20,000-50,000

- Water (WASA): ৳10,000-30,000

- Gas (Titas): ৳30,000-1 lakh

- Internet/Telephone: ৳5,000-15,000

- Parking Space (if not included): ৳5-15 lakhs for residential

- Sinking Fund (one-time): ৳50,000-2 lakhs for future repairs

- Interior & Renovation: ৳3-15 lakhs (for semi-finished flats)

- Monthly Maintenance: ৳3-10 per square foot (₳3,000-10,000/month for 1,000 sq ft)

- Elevator Maintenance: Additional ৳1,000-3,000/month

- Home Loan Interest & Processing: Varies by bank

How to Avoid It:

Create a comprehensive budget that includes:

- Purchase price

- Down payment (typically 20-30%)

- All legal and registration fees (research actual rates)

- Utility connection charges (contact DESA, WASA, Titas for current rates)

- Parking costs (if needed)

- Sinking fund contribution

- Interior completion and furnishing

- Maintenance reserve for first year

- Loan interest calculations (if financing)

- Tax implications (stamp duty typically 0.5%, registration fees)

Recommendation: Add 15-20% buffer to your total budget for unexpected expenses. Many financial advisors suggest that total apartment cost should not exceed 4-5 times your annual household income if financing.

Mistake #2: Not Defining Your Needs & Priorities Clearly

The Problem: Emotional excitement or FOMO (fear of missing out) leads buyers to purchase apartments that don’t match their actual lifestyle requirements or future plans.

Critical Questions to Answer First:

- Is this for living or investment? Your priorities differ significantly if you plan to occupy the space versus rent it out.

- Location considerations:

- How long is your commute to workplace(s)?

- Are schools and educational institutions nearby?

- What are the nearby hospitals and healthcare facilities?

- Is there adequate public transportation?

- Will daily needs (groceries, markets, banks) be accessible?

- Future infrastructure development plans?

- Size and configuration:

- How many bedrooms do you actually need?

- What’s your household size now and in 5-10 years?

- Do you work from home (office space needed)?

- Amenities:

- Which amenities matter most (gym, pool, community center)?

- Higher amenities = higher maintenance costs

- Are amenities actually operational and well-maintained?

- Neighborhood vibes:

- Visit at different times of day (morning, evening, night)

- Talk to existing residents about the area

- Check noise levels and traffic patterns

- Assess security and neighborhood safety

How to Avoid It:

- Make a priority list: rank location, size, amenities, price, and other factors

- Distinguish between “needs” (must-haves) and “wants” (nice-to-haves)

- Visit properties multiple times and in different conditions

- Don’t let marketing hype override your actual requirements

- Consider long-term resale/rental potential alongside immediate comfort

Mistake #3: Insufficient Market Research & Developer Verification

The Problem: Buyers accept the first offer or trust developers without verifying their credibility, leading to fraud, project abandonment, or poor investment decisions.

What You Must Research:

Developer Track Record:

- How many projects have they completed?

- Were projects delivered on time? (Delayed handovers are rampant in Bangladesh)

- Are past customers satisfied? (Check references and online reviews)

- Visit and inspect their completed projects

- Check financial stability: are they registered with REHAB (Real Estate and Housing Association of Bangladesh)?

- Any ongoing legal disputes or complaints?

Market Comparison:

- What are comparable properties selling for in your target area?

- How has pricing trended over the past 2-3 years?

- What are rental yields if you’re investing?

- What’s the demand-supply situation in that location?

- Are there upcoming infrastructure projects (metro, flyovers, commercial zones)?

Developer Legitimacy Red Flags:

- Not registered with REHAB

- No verifiable track record

- Pressure to pay large upfront amounts

- Reluctance to provide legal documentation

- Too-good-to-be-true pricing

- Promotional offers that seem extortionate

How to Avoid It:

- Use trusted real estate agents (but verify their credibility too)

- Consult with real estate lawyers before commitment

- Visit the developer’s completed projects and speak with residents

- Verify developer registration with REHAB and RAJUK

- Check with Bangladesh Bank if they’re financing through non-legitimate channels

- Cross-reference property details at the Sub-Registry Office

- Take your time – legitimate developers respect due diligence

Section 2: Key Mistakes During Selection & Inspection

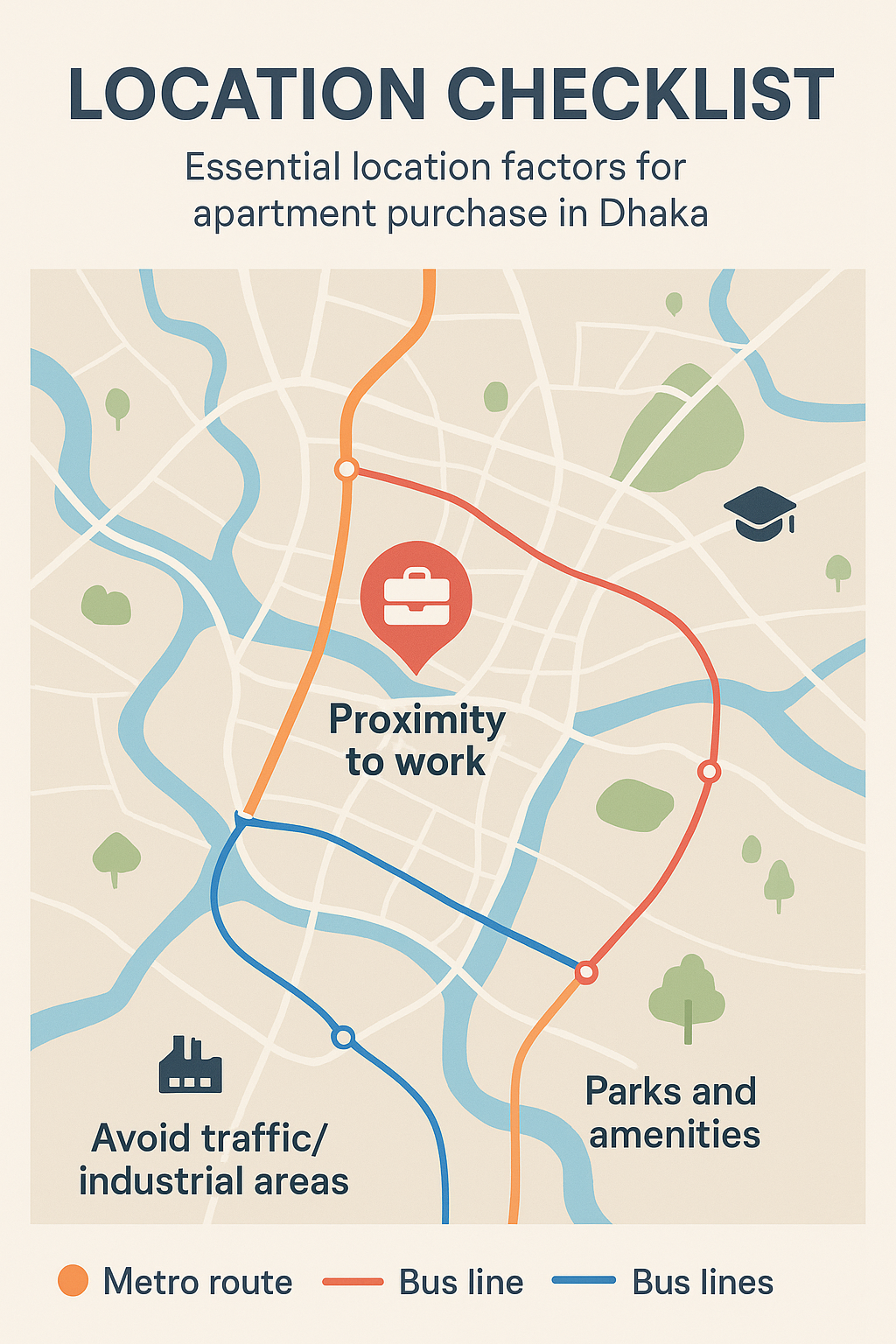

Mistake #4: Ignoring Location & Connectivity Issues

The Problem: A beautiful apartment in a poor location becomes a source of regret. Location determines quality of life, resale value, and rental income potential.

Location Assessment Checklist:

Transportation & Accessibility:

- Distance to workplace (current and future plans)

- Public transport availability and frequency

- Road condition during rainy season (waterlogging is a chronic Dhaka problem)

- Accessibility for heavy vehicles, ambulances, fire trucks

- Parking availability (street or designated)

Daily Amenities:

- Hospitals and diagnostic centers (distance and quality)

- Schools, colleges, universities

- Shopping areas and supermarkets

- Banks and ATMs

- Gas stations and service centers

- Places of worship

Quality of Life:

- Noise levels (industrial areas, highways, railway)

- Air quality (near traffic intersections or industrial zones)

- Green spaces and parks

- Water quality and supply reliability

- Community and neighborhood atmosphere

Future Development:

- Upcoming metro/bus transit hubs?

- Commercial zone development?

- Airport expansion or new routes?

- Infrastructure improvements planned?

- These can increase property value significantly

How to Avoid It:

- Visit the location at different times: morning rush hour, midday, evening, and night

- Talk to 5-10 residents about their experience

- Research past 2-3 years’ property appreciation in the area

- Check RAJUK’s Detailed Area Plan (DAP) for future zoning changes

- Assess worst-case scenarios (waterlogging during monsoon, etc.)

- Consider your lifestyle – don’t compromise on location for a slightly cheaper price

Mistake #5: Failing to Verify Legal & Documentation Status

The Problem: This is perhaps the most critical mistake – legal issues can invalidate your ownership, trap you in decades-long disputes, or result in complete financial loss.

Bangladesh Legal Framework:

The following laws govern apartment ownership in Bangladesh:

- Apartment Ownership Act, 2000: Defines legal status of apartments

- Real Estate Development and Management Act, 2010: Governs developer responsibilities

- Transfer of Property Act, 1882 & Registration Act, 1908: Controls property transfers

- Local Authority Bylaws: RAJUK (Rajdhani Unnayan Kartripakkha) for Dhaka

Critical Documents You MUST Verify:

- Title Deed & Ownership Chain:

- Original title deed (not photocopy)

- Complete ownership history for past 25 years

- Mother deed showing original land registration

- All intermediate sale deeds

- RAJUK Approvals:

- Building plan approval certificate

- Compliance with Detailed Area Plan (DAP 2022-2035)

- Floor Area Ratio (FAR) compliance

- Occupancy certificate or completion certificate

- Land Records:

- Khatiyan (record of rights)

- Mutation (namjari) certificate

- CS/SA/RS survey records

- City Survey documentation

- Proof of tax payment

- Building Compliance:

- Bangladesh National Building Code (BNBC) compliance

- Fire safety certificates

- Structural drawings approval

- Environmental Impact Assessment (EIA) for large projects

- Financial & Legal Status:

- Encumbrance Certificate (proves no outstanding loans/disputes)

- No Objection Certificate from original landowner (if applicable)

- Property tax receipts

- Verification that property isn’t under government embargo

- Apartment-Specific Documents:

- Apartment Ownership Certificate

- Deed of Declaration (common areas, building maintenance rules)

- Bylaws of the Apartment Owners’ Association

Common Legal Red Flags:

- Documents are photocopies only

- Inconsistencies in property descriptions

- Multiple “owners” claiming the same property

- Property under litigation

- Encumbrance certificate showing outstanding mortgages

- Missing RAJUK approvals or forged approvals

- Building constructed against approved plans

How to Avoid It:

- Hire a qualified real estate lawyer (non-negotiable for significant purchases)

- Verify all documents at the Sub-Registry Office personally

- Obtain encumbrance certificate from the registry

- Cross-check building compliance at RAJUK offices

- Verify developer’s REHAB registration

- Conduct title search for past disputes

- Never proceed without a clear, written title

- Include all legal conditions in the purchase agreement

- Get arbitration clause in agreement for dispute resolution

What Happens Without Verification:

- Double registration/multiple buyers of same unit

- Developer fraud (unlicensed companies)

- Property seized by government

- Stuck in years of legal battles costing lakhs in lawyer fees

- Unable to sell, mortgage, or legally occupy the property

Mistake #6: Overlooking Construction Quality & Unit Layout Issues

The Problem: Show units are pristine and misleading. Real units often have structural defects, poor layout, ventilation issues, or construction shortcuts that become expensive problems.

What to Inspect Physically:

Structural Elements:

- Are walls straight and vertical? (Use water level or app to check)

- Are there cracks in walls, ceiling, or floor?

- Signs of water leakage or dampness?

- Quality of brick/concrete work (poorly done will show)

- Proper compaction and finishing

Layout & Functionality:

- Natural light from windows (check orientation – north/south facing)

- Cross-ventilation adequate? (All rooms should have windows for air flow)

- Layout makes sense for your lifestyle?

- Bedroom orientation and privacy

- Kitchen size and counter space

- Bathroom ventilation (risk of mold otherwise)

- Corridor space (some buildings waste space poorly)

Plumbing & Electrical:

- Water pressure (turn on taps, flush toilets)

- Electrical outlets and switches placement

- Internet/cable provisions visible?

- Proper earthing visible?

- Water tank location and capacity

Finishes & Materials:

- Door hinges and lock quality

- Window quality and sealing

- Paint and wall finish quality

- Flooring (tiles, wood) quality

- Sanitary fittings brand and quality

Common Areas:

- Lift condition and maintenance

- Staircase width and safety

- Corridor cleanliness and maintenance

- Water storage capacity for all units

- Parking arrangement and cleanliness

- Security measures

Show Unit vs Real Unit Comparison:

- Show units are decorated and maintained better

- Real units often have hastier construction

- Visit multiple units in the building

- Visit a completed building by same developer for realistic picture

- Never buy based on show unit alone

How to Avoid It:

- Hire a structural engineer to inspect: ৳5,000-15,000 well-spent

- Visit multiple real units, not just show unit

- Check completed buildings by same developer

- Get a professional inspection report in writing

- Use inspection findings to negotiate price or request repairs

- Verify BNBC compliance and building safety standards

- Request copies of building drawings and plans

- Check water and electrical supply adequacy

Mistake #7: Falling for “Too Good to Be True” Deals & Hidden Charges

The Problem: Promotional offers, discounts, and freebies distract buyers from red flags. Hidden charges snowball into financial stress.

Common Deceptive Practices:

Illusory Discounts:

- “50% discount” often means only on basic price, not registration/legal fees

- “Free parking” often becomes paid after handover

- “Free interior” might be poor quality finish only

- Discount conditional on paying large lump sum upfront (cash flow advantage to developer)

Hidden Charges Revealed After Purchase:

- Corpus Fund: ৳50,000-2 lakhs for building reserves (emergency repairs, re-investment)

- Parking Fee: ৳5-15 lakhs if not included, even if you don’t want it

- Club Membership: Mandatory ৳1-5 lakhs to join society club

- Name Transfer: Costs typically 1-2% of property value

- Sinking Fund: Annual contribution ৳1-3 lakhs for building maintenance reserves

- Extra Charges: For premium floor, corner unit, higher floor, larger balcony

Marketing Pressure Tactics:

- “Only 2 units left!” (usually not true)

- “Price increasing next month” (artificial urgency)

- “Handover next month” (often delayed significantly)

- Celebrity endorsements or testimonials (not necessarily legitimate buyers)

How to Avoid It:

- Get everything in writing – don’t rely on verbal promises

- Ask for detailed cost breakdown before committing

- Clarify what’s included vs what’s extra

- Verify discount legitimacy (ask for comparable units without discount)

- Calculate total cost, not just monthly installment

- Review all charges in purchase agreement

- Talk to existing residents about hidden charges they faced

- Never pay lump sum based on promises of discounts

Section 3: After Selection – The Financial & Ownership Phase

Mistake #8: Not Accounting for Maintenance & Operational Costs

The Problem: Many buyers shock when receiving their first maintenance bill. These costs accumulate significantly over 25+ years of ownership.

What’s Included in Maintenance Charges:

- Salaries for security guards, gardeners, caretakers, managers

- Lift/elevator maintenance and spare parts

- Plumbing and electrical repairs

- Painting and structural maintenance

- Common area cleaning and pest control

- Water supply system maintenance

- Backup generator fuel and maintenance

- Park or garden upkeep (if any)

- Community events and functions

- Building insurance contributions

Maintenance Variation Factors:

| Factor | Impact |

|---|---|

| Location (Gulshan vs. Moghbazar) | Gulshan charges 2-3x higher |

| Number of Amenities | Swimming pool, gym add ৳2,000-5,000/month |

| Building Age | Older buildings have higher maintenance |

| Building Height | High-rise lifts = higher elevator costs |

| Unit Size | Larger units pay proportionally more |

| Number of Residents | More residents = shared costs = lower individual burden |

Typical Monthly Maintenance:

- Standard apartment (1,000 sq ft): ৳3,000-10,000/month

- Luxury apartment (2,000+ sq ft): ৳10,000-30,000/month

- Premium locations (Gulshan, Banani): ৳15,000-50,000/month

Long-term Cost Example:

- 30-year ownership with average ৳7,000/month maintenance

- Total maintenance cost: ৳25.2 lakhs

- Plus major repairs: structural issues, roof replacement, piping replacement

- Total could reach ৳40-50 lakhs over ownership period

How to Avoid It:

- Check maintenance charges of similar buildings before purchase

- Ask building management for maintenance breakdown

- Talk to residents about unexpected charges

- Budget for major repairs every 10-15 years

- Avoid buildings with excessive amenities you don’t use

- Check building’s reserve fund status (well-maintained buildings have better reserves)

- Understand how maintenance committee operates

- Request audit of building accounts

Mistake #9: Rushing or Making Pressured Decisions

The Problem: Emotional buying, FOMO, and marketing pressure lead to hasty commitments that buyers regret for decades.

Pressure Tactics You’ll Encounter:

- “Deadline tomorrow for this price”

- “Someone else is interested in this unit”

- “Price will increase next week”

- “Only 2 units remaining”

- “Handover soon, don’t miss out”

- Developer offers “favorable terms if you decide today”

Emotional Buying Triggers:

- You fall in love with the show unit aesthetic

- You’ve been searching for months (emotional exhaustion)

- Your family is excited about the location

- You feel pressure from spouse/parents

- You worry about missing an opportunity

Why Rushing Backfires:

- No time for proper legal verification

- Skipped professional inspection

- Didn’t research developer thoroughly

- Missed hidden charges in fine print

- Didn’t compare with alternatives

- Purchased in poor market conditions

How to Avoid It:

- Set a timeline for your decision: minimum 2-4 weeks after identifying a property

- Do comprehensive research before visiting: know market, developers, regulations

- Make at least 3 site visits: different times of day and in different weather

- Get independent expert opinions: lawyer, structural engineer, real estate consultant

- Compare minimum 5-10 properties: don’t decide based on first option

- Sleep on major decisions: don’t sign anything on the same day

- Involve trusted advisors: spouse, parents, friends – get second opinions

- Trust your gut: if something feels wrong, it probably is

- Ignore marketing urgency: good properties will always be available

- Get everything in writing before making payment commitment

Mistake #10: Neglecting Resale/Rental Potential & Future Value

The Problem: Buyers purchase based purely on liking the space, without considering resale or rental value, leading to poor investments and liquidity issues.

Key Resale/Rental Value Factors:

Location Quality:

- Proximity to employment centers

- Transportation accessibility

- Neighborhood reputation and development

- Future infrastructure projects

- Schools and medical facilities nearby

Property Condition:

- Well-maintained building command premium prices

- Poor maintenance significantly reduce value

- Age and structural condition matter

Market Trends:

- Has the area appreciated or depreciated historically?

- Is demand increasing or declining?

- Are developers still building there (indicates confidence)?

Amenities & Configuration:

- 2-3 bedroom units are most marketable

- Standard configurations more rentable than odd layouts

- Popular amenities (parking, lift) command premium

Investment Math:

- Rental yield (annual rent / property price): Look for 5%+ yields

- Appreciation potential: Historical 3-5% annual appreciation in good areas

- Liquidity: How easily can you sell if needed?

Examples of Poor Investment Decisions:

- Buying isolated location to save money: Resale value stagnates

- Purchasing in declining neighborhood: Value depreciates

- Choosing odd floor/layout: Difficult to rent or sell

- Overpaying for temporary boom: Market corrects, you’re underwater

- Buying in unproven area without infrastructure: No demand for resale

How to Avoid It:

- Research historical price trends (5-10 years)

- Compare appreciation rates across different areas

- Check rental market for similar properties

- Calculate potential rental yield

- Consult real estate investment experts

- Consider area’s development plans and potential

- Choose 2-3 bedroom units (most marketable)

- Avoid overly trendy but temporary hotspots

- Factor 10-15% vacancy in rental yield calculations

- Don’t overpay for premium amenities you won’t use

Section 4: Practical Checklist & Buyer’s Action Plan

Pre-Purchase Verification Checklist

DEVELOPER & COMPANY VERIFICATION

- Developer registered with REHAB

- Developer registered with RAJUK

- Minimum 3-5 completed projects verified

- Check online reviews and ratings

- Visit 2-3 completed buildings by developer

- Speak with 5-10 residents from completed projects

- Check with Bangladesh Bank for financing legitimacy

- Verify company’s financial stability

- Check for ongoing legal disputes or complaints

- Confirm project insurance and completion guarantee

LOCATION & CONNECTIVITY ASSESSMENT

- Visit location at different times (morning, noon, evening, night)

- Travel to workplace during peak hours

- Check proximity to schools, hospitals, markets

- Assess public transportation availability

- Visit area during monsoon season (waterlogging check)

- Talk to 5-10 area residents about neighborhood

- Check noise levels and air quality

- Research future infrastructure projects (metro, flyovers)

- Verify proximity to undesirable facilities (industrial zones, cemeteries)

- Check road access for emergency vehicles

LEGAL DOCUMENTS & VERIFICATION

- Obtain and review original title deed

- Verify 25-year ownership history

- Check mother deed and all intermediate sale deeds

- Obtain encumbrance certificate (no outstanding loans)

- Verify RAJUK building approval certificate

- Confirm RAJUK occupancy/completion certificate

- Check compliance with Detailed Area Plan (DAP)

- Verify Bangladesh National Building Code (BNBC) compliance

- Confirm fire safety certificate

- Check khatiyan, mutation, and tax records

- Verify No Objection Certificate from original landowner

- Get written proof: property not under litigation or embargo

- Verify apartment building’s Deed of Declaration

- Check property tax payment receipts (current)

- Hire lawyer to do comprehensive title search

- Ensure arbitration clause in purchase agreement

FINANCIAL & COST BREAKDOWN

- Get itemized cost breakdown (purchase price, registration, utilities, etc.)

- Clarify all hidden charges upfront

- Confirm parking costs (included or separate)

- Verify corpus fund requirements

- Check maintenance charge estimate

- Understand sinking fund contributions

- Confirm stamp duty and registration fee rates

- Get loan pre-approval from bank (if financing)

- Understand all loan terms and interest rates

- Calculate total cost including all charges

- Add 15-20% buffer for unexpected costs

- Verify developer’s payment plan flexibility

- Confirm refund policy if developer fails to deliver

PROPERTY INSPECTION

- Hire certified structural engineer (non-negotiable)

- Visit multiple real units (not just show unit)

- Check wall straightness and cracks

- Inspect water pressure and drainage

- Test electrical outlets and switches

- Check for dampness, leakage, or water stains

- Verify natural light and ventilation in all rooms

- Assess layout functionality for your needs

- Check quality of doors, windows, and finishes

- Verify lift/elevator functionality

- Inspect common areas for maintenance

- Get professional inspection report in writing

- Use inspection findings to negotiate price or repairs

- Take photographs and video of property

- Compare with completed buildings by same developer

DEVELOPER COMMUNICATION

- Get everything in writing (not verbal promises)

- Confirm handover date, exact specifications, and penalties

- Clarify what’s included and what’s extra

- Get written explanation of all charges and fees

- Request building completion timeline and updates

- Confirm defect rectification period and process

- Get contact information for developer’s customer service

- Request list of current residents for reference

- Ask for copies of all approvals and certificates

- Verify contact of approved civil engineer for building

EXPERT CONSULTATION

- Consult with real estate lawyer

- Get structural engineer inspection

- Consider real estate investment consultant

- Discuss with bank for financing options

- Get insurance agent to quote building/contents insurance

- Seek opinion from 3-5 trusted friends/family

Recommended Professionals to Consult

1. Real Estate Lawyer (ESSENTIAL)

- Verifies all legal documents

- Conducts title search

- Drafts purchase agreement

- Ensures compliance with laws

- Represents you in disputes

- Cost: Typically ৳10,000-50,000 depending on property value

2. Structural/Civil Engineer (HIGHLY RECOMMENDED)

- Inspects building structure and materials

- Verifies BNBC compliance

- Identifies defects and repair costs

- Provides written inspection report

- Cost: ৳5,000-15,000 per inspection

3. Real Estate Investment Consultant (RECOMMENDED)

- Analyzes property investment value

- Compares market rates and trends

- Calculates ROI and rental yield

- Advises on location potential

- Cost: ৳5,000-20,000 for consultation

4. Licensed Real Estate Agent (USE WITH CAUTION)

- Helps identify available properties

- Provides market knowledge

- Facilitates negotiations

- Arranges site visits

- Ensure they’re properly licensed and registered

- Cost: Commission typically 1-2% of property price (negotiate)

5. Insurance Agent

- Advises on building insurance

- Calculates appropriate coverage

- Explains terms and conditions

- Cost: Included in insurance premium

Questions Every Buyer Should Ask

About the Developer:

- How many projects have you completed and where are they located?

- What was the handover timeline for your previous projects?

- Are you registered with REHAB? (Ask for certificate)

- Can I speak with residents of your previous projects?

- What’s your building completion guarantee or insurance?

- How do you handle post-handover defects or maintenance issues?

About the Property:

- What’s the exact built-up area and common area area?

- What all is included in the quoted price?

- What’s the breakdown of registration, legal, and utility connection fees?

- What’s the corpus/sinking fund requirement?

- What are the expected monthly maintenance charges?

- Is parking included or separate? How much extra?

- What happens if you deliver late? (Look for penalty clause)

About Legal Status:

- Is the RAJUK approval for this plot/building?

- What’s the occupancy certificate status?

- Is the property under any litigation?

- Are there any outstanding mortgages or encumbrances?

- Can I get copies of all approvals and certificates?

- Has the property been registered before or is this new registration?

About Location:

- What’s your plan for future area development?

- Are there any upcoming infrastructure projects nearby?

- What’s the rental demand in this area?

- What’s been the historical property appreciation here?

- How far is this from major employment centers?

- What’s the public transportation situation?

About Timeline & Payment:

- When’s the exact handover date?

- What’s the payment schedule? Any flexibility?

- What happens if construction is delayed? (Penalty clause)

- What’s your defect rectification timeline?

- What’s the completion guarantee or insurance policy?

- Can I get EMI flexibility if financing through bank?

Protect Your Biggest Investment

Buying an apartment in Bangladesh represents a long-term commitment – typically 25-30+ years of ownership and one of your family’s largest financial decisions. The difference between a smart purchase and a problematic one is thorough due diligence, expert consultation, and patient decision-making.

Key Takeaways:

- Take your time: no legitimate developer will pressure you unreasonably

- Get professional help: lawyers, engineers, and consultants save far more than they cost

- Verify everything: legal documents, developer credentials, building compliance

- Budget comprehensively: hidden costs can add 15-25% to stated price

- Assess resale potential: don’t buy in isolation from future market value

- Trust your instincts: if something feels wrong, investigate further

- Document everything: written agreements, inspection reports, all communications

- Ask questions: keep asking until you’re confident

By avoiding these ten common mistakes, you protect your investment, secure your family’s future, and gain peace of mind that comes with a well-researched, legally sound property purchase.

Frequently Asked Questions About Apartment Buying

Q: What’s the most important document I need to verify when buying an apartment?

A: The original title deed showing at least 25 years of ownership history. Without a clear, unencumbered title, you risk fraud, legal disputes, or seizure. Always hire a lawyer to verify the complete ownership chain at the Sub-Registry Office.

Q: How much should I budget for hidden costs beyond the apartment price?

A: Plan for 15-25% additional costs. These include registration fees (3-6 lakhs for ৳1 crore property), utility connection charges (50,000-1+ lakh), parking (if separate, 5-15 lakhs), sinking fund, interior completion, and first-year maintenance reserves.

Q: Is hiring a lawyer worth the cost when buying an apartment?

A: Absolutely essential, not optional. Lawyer fees (৳10,000-50,000) are minimal compared to the risk of legal fraud, double registration, or property disputes that could cost lakhs and years of legal battles. Many sellers/developers who refuse legal verification are red flags.

Q: What should I do if the developer delays the handover?

A: Under Bangladesh’s Real Estate Development and Management Act 2010, you’re entitled to compensation if handover is delayed. The act specifies 15% compensation on total paid amount if no specific compensation clause exists. Ensure your agreement includes clear penalty clauses for delays and pursue arbitration through REHAB before litigation.

Q: How can I verify a developer hasn’t committed fraud?

A: Check REHAB registration, verify RAJUK approvals, visit multiple completed projects, speak with residents, check for legal complaints, verify company financial stability with Bangladesh Bank, and ensure proper documentation exists. Don’t rely on verbal promises or show units alone.

Q: What’s the difference between a show unit and a real unit?

A: Show units are professionally decorated, perfectly maintained, and carefully selected. Real units are standard construction with normal wear. Always visit multiple actual units, not just show units, and compare with completed buildings by the same developer to understand realistic conditions.

Q: How do I calculate if an apartment is a good investment?

A: Calculate rental yield (annual rent ÷ property price; aim for 5%+), check historical area appreciation (3-5% annually is normal), consider liquidity (how easily can you sell), and factor maintenance costs. Avoid overpaying for temporary trends or purchasing in declining neighborhoods.

Q: What should I look for during a structural inspection?

A: Straight walls and ceilings (use water level), no visible cracks, adequate water pressure and drainage, proper ventilation in all rooms, quality of electrical work and outlets, signs of dampness or leakage, and BNBC compliance. Hire a certified structural engineer; don’t rely on visual inspection alone.

Q: Can I back out of an apartment purchase after signing the agreement?

A: This depends on your purchase agreement terms. Most agreements specify penalties if the buyer cancels (typically 10-20% forfeiture). Some agreements include cancellation clauses under specific conditions (financing approval failure, defects discovered). Always clarify cancellation terms and penalties before signing.

Q: What’s the typical payback period for a rental property in Dhaka?

A: Typically 15-20 years depending on location and rental rates. Good areas with strong rental demand might achieve 12-15 years. Premium locations with lower yields might extend to 20+ years. Calculate based on specific property: (Property Price) ÷ (Annual Rental Income) = Payback Period.

Q: What happens if the developer goes bankrupt before handover?

A: You may lose your invested money depending on the agreement and legal status. This is why RAJUK approval, occupancy certificates, and builder insurance are critical. Ensure agreements include completion guarantees or developer insurance. REHAB provides some buyer protection for registered developers.

Q: Should I pay in cash or financing? What’s the advantage of each?

A: Cash advantages: No interest payment, faster process, better negotiation position. Cash disadvantages: Large upfront capital requirement, no leverage. Financing advantages: Leverage money, maintain liquidity, spreads payments. Financing disadvantages: Interest costs (typically 8-11%), longer process, bank approval conditions. Choose based on your financial situation and market conditions.

Q: Is it worth buying an apartment in a new, unproven area?

A: Risky. New areas lack infrastructure, rental demand, and price stability. Wait for infrastructure development (metro, commercial zones) before prices rise. Established areas offer better liquidity, rental demand, and predictable appreciation. New areas suit high-risk investors only.

Q: What’s included in apartment maintenance charges?

A: Typically: security, gardening, building cleaning, elevator maintenance, plumbing/electrical repairs, water supply maintenance, backup generator fuel, common area upkeep, pest control, and community events. Swimming pools and gyms increase charges by ৳2,000-5,000/month. Request detailed breakdown before purchase.

Q: How do I verify if an apartment has proper RAJUK approval?

A: Request the building plan approval certificate directly from RAJUK or have your lawyer verify at RAJUK offices. Confirm the building complies with the Detailed Area Plan (DAP 2022-2035) and has occupancy certificate. Forged documents are common; verify with original authorities, not just developer’s copies.

Q: What recourse do I have if I discover fraud after purchase?

A: You can pursue legal action under the Real Estate Development and Management Act 2010, file complaints with REHAB or RAJUK, or seek arbitration (if arbitration clause exists in agreement). However, litigation is lengthy and expensive. Prevention through proper due diligence is far better than legal action afterward.

Expert Bio

Muhammad Nayeem Ferdous serves as Chairman and Founder of AmarGhorBD (360 Degree Property Services), a leading real estate consultancy firm specializing in residential and commercial property development, investment analysis, and buyer protection in Bangladesh.

With an MBA from Macquarie University (Australia) and over 5 years of specialized experience in the Bangladesh real estate sector, Muhammad Nayeem brings institutional expertise and international best practices to property transactions.

Through AmarGhorBD’s 360-degree approach, Muhammad Nayeem helps hundreds of families and investors navigate Bangladesh’s complex real estate market with confidence, ensuring informed decisions and protected investments. His consultancy emphasizes transparency, comprehensive research, and expert verification at every stage of property purchase – from initial market research through legal completion and handover.

People Also Ask: Common Questions

Q: What are the most common apartment buying mistakes in Bangladesh?

A: The most frequent mistakes include: (1) not verifying legal documents and RAJUK approvals, leading to fraud or ownership disputes; (2) ignoring hidden costs that add 15-25% to quoted price; (3) rushing decisions due to marketing pressure, skipping proper due diligence; (4) insufficient inspection of construction quality, missing structural defects; (5) poor location selection despite affordability, resulting in low resale value and poor quality of life; (6) not researching developer track record, leading to project delays or abandonment; (7) overlooking maintenance costs that become significant over time; (8) not accounting for resale potential, purchasing for emotion rather than investment value. Most of these mistakes can be prevented through patient research, professional consultation, and thorough verification.

Q: How can I identify if a real estate developer is fraudulent in Bangladesh?

A: Red flags include: (1) not registered with REHAB or RAJUK; (2) no verifiable completed projects; (3) pressure to pay large upfront amounts; (4) reluctance to provide legal documentation; (5) “too good to be true” pricing compared to market; (6) no clear contact information or professional office; (7) making verbal promises not in writing; (8) unwillingness to provide past customer references; (9) no building insurance or completion guarantee; (10) presence of online complaints or legal disputes. Always verify developer registration at REHAB and RAJUK, visit their completed projects, speak with residents, and consult a real estate lawyer before commitment.

Q: What legal documents are essential to verify before buying an apartment?

A: Essential documents include: (1) Original title deed with 25-year ownership history; (2) RAJUK building plan approval certificate; (3) Occupancy or completion certificate; (4) Encumbrance certificate proving no outstanding loans; (5) Khatiyan and mutation records; (6) Deed of Agreement and sale deed; (7) No Objection Certificate from original landowner; (8) Building compliance with Bangladesh National Building Code; (9) Fire safety certificate; (10) Apartment Building’s Deed of Declaration; (11) Proof of property tax payment. Never proceed without verifying these through official channels and consulting a qualified real estate lawyer.

Q: How much should my total apartment budget include beyond the quoted price?

A: Budget for 15-25% additional costs: Registration and legal fees (3-6 lakhs for ৳1 crore property), electricity connection (20,000-50,000), water connection (10,000-30,000), gas connection (30,000-1 lakh), parking if separate (5-15 lakhs), sinking fund (50,000-2 lakhs), interior completion for semi-finished apartments (3-15 lakhs), first-year maintenance reserve (30,000-50,000), and loan processing fees if financing. Create a comprehensive budget including all these elements, add a 15-20% buffer for contingencies, and ensure your total cost doesn’t exceed 4-5 times your annual household income if financing.

Q: What happens if a developer doesn’t deliver an apartment on schedule?

A: Under the Real Estate Development and Management Act 2010, Section 15, the developer must refund total amount paid plus compensation at 15% of total paid amount (if no specific rate is mentioned in agreement), paid via account payee cheque within 6 months. Ensure your agreement includes a clear penalty clause for delays. You can pursue arbitration through REHAB if the agreement includes an arbitration clause, or pursue litigation if not. However, the process often takes years and costs substantial legal fees, so prevention through clear agreements upfront is important.

Q: Is it worth buying an apartment as an investment vs living in it?

A: This depends on your financial situation and goals. Investment apartments should be evaluated on rental yield (aim for 5%+), historical area appreciation (3-5% annually), and resale liquidity. Living apartments prioritize location (commute, schools, amenities) and personal comfort. Many buyers do both – live in the apartment while its value appreciates, then sell at profit or rent it out later. For pure investment, focus on locations with strong rental demand and proven appreciation. For personal living, prioritize location quality and resale potential alongside immediate comfort.

TL;DR: Quick Summary for Busy Buyers

Before You Buy:

- Set realistic budget: add 15-25% beyond quoted price for hidden costs

- Define needs vs wants: location matters more than amenities

- Research developer: visit completed projects, speak with residents

- Verify market: compare prices, check appreciation trends

During Selection:

- Verify legal documents: hire lawyer, check title deed, RAJUK approval, encumbrance certificate

- Inspect property: hire structural engineer, visit multiple real units, not just show unit

- Location assessment: visit different times of day, check waterlogging, accessibility

- Avoid hidden charges: get itemized cost breakdown, clarify all fees upfront

After Selection:

- Don’t rush: take minimum 2-4 weeks after property identification

- Get expert opinions: lawyer, engineer, investment consultant

- Understand maintenance: research actual charges in building

- Consider resale potential: balance immediate comfort with future value

Critical Documents:

- Original title deed (25-year ownership history)

- RAJUK building approval and occupancy certificate

- Encumbrance certificate (no outstanding claims)

- Khatiyan and mutation records

- Building compliance certificates (BNBC, fire safety)

Red Flags:

- Developer not registered with REHAB/RAJUK

- Pressure to pay large upfront amounts

- No verifiable completed projects

- Reluctance to provide legal documentation

- “Too good to be true” pricing

Bottom Line: Buying an apartment is complex and high-stakes. Patience, professional consultation, and thorough verification prevent costly mistakes and secure your family’s largest investment.